Business Case: How the Trillion-Yuan Giant Bull Group Rose Rapidly

Known as the "King of Sockets," Bull Group (SH603195) is an industry giant that grew from a niche segment.

Through this company, we can also see the shadow of China's manufacturing rise—from nothing to something, from products to brands, and from small workshops to industry giants.

An Industry Giant Growing from a Niche Segment

Founded in 1995 by entrepreneur Ruan Liping, Bull Group is a civil electrical enterprise that initially positioned itself with the strategy of "manufacturing durable sockets." It stood out in the competitive socket market, earning the title "Socket King of China." According to the "2022 China IT Brand Market Share Survey Report," Bull Group holds a dominant position in the socket market with a market share exceeding 60%. Both industry insiders and ordinary consumers describe Bull as: "In China, there are two types of sockets—Bull and other brands."

In February 2020, Bull Group went public on the A-share market. Within just 9 days, its market value soared from about 50 billion yuan to over 100 billion yuan, reaching a peak value of over 150 billion yuan.

As the leader in the socket industry with hundreds of billions in revenue and market value, Bull Group followed the development of China's manufacturing industry and began diversifying its product line. From 2014 to 2016, Bull expanded into the LED, digital accessories, and charger products sectors. In 2021, the company also ventured into the charging pile business, hoping to seize opportunities in the growing new energy vehicle market.

The Era Background: Industrial Cluster Opportunities During China's Manufacturing Start-Up Phase

Bull originated in Cixi, known as the "Small Appliance Capital of China." Located in Zhejiang Province, Cixi covers an area of 1,361 square kilometers and has a permanent population of approximately 1.86 million. Despite being a county-level administrative unit, Cixi has a large concentration of small electrical appliance factories.

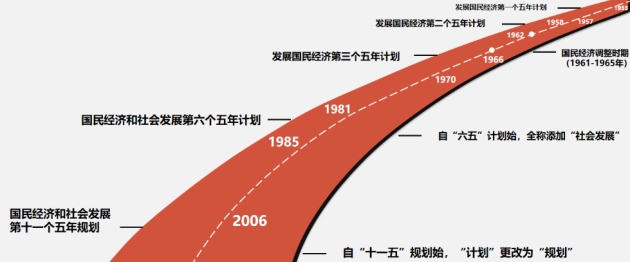

In the 1980s, as China’s urbanization began, rapid urban and housing construction drove significant growth in electrical demand. On the eve of this explosion in the home appliance industry, a group of private enterprises engaged in hardware and plastic production in Cixi emerged. Sockets, as a subset of the hardware industry, were particularly prominent in Cixi, where hundreds of small workshops focused solely on socket production.

At that time, China’s socket market was highly competitive, with local enterprises reformed from state-owned factories, foreign and joint venture enterprises, and small businesses engaged in workshop-style production.

In the early days of China’s manufacturing industry, small and medium-sized enterprises (SMEs) gradually became a mainstream force in the market, making significant contributions to China's manufacturing growth. Many industry giants grew from these small businesses, and Bull Group is a representative example of such a rise, seizing the opportunity presented by the times.

Today, Cixi’s small appliance industry holds about 50% of China's market share, with more than 10,000 appliance accessory factories. From component design, development, and processing to the manufacturing of complete appliances, Cixi has formed a complete industrial chain. This has made Cixi one of the three major "small appliance industrial bases" in China, alongside Shunde in Guangdong and Qingdao in Shandong.

The cluster-based industrial development is one of the key characteristics of China’s manufacturing industry. When we analyze the development histories of these successful companies, we realize that they were all in the right place at the right time, doing the right things—this is the opportunity of the times, allowing someone without any resource background to rise rapidly.

Product Positioning: The Core Pain Point of the Industry Is "Safety"

At that time in China, the socket industry lacked unified standards, providing survival space for small workshop-based businesses but also leading to a market filled with uneven product quality. Many workshop-produced sockets lacked quality guarantees and posed significant safety risks, such as frequent power outages, overheating, and, in extreme cases, short circuits, smoke, or even fires.

Bull Group correctly identified the industry's core pain point—safety—as its brand positioning.

While others were busy searching for customers in the market, Ruan Liping invested all his time and energy into research and development. From product R&D, manufacturing, quality control, to design, Ruan was hands-on, personally involved in every detail. His investment in panel materials was more than twice that of other small workshops.

At the time, many socket panels lacked a safety button design. To disconnect power, users had to pull out the plug, which could wear out the socket and cause screws and components to loosen, increasing safety risks.

To address this issue, Bull Group innovatively introduced sockets with a switch button in 1996. This design allowed users to control the electrical circuit simply by pressing a button, greatly improving safety. Today, most socket products in China have adopted this landmark button design pioneered by Bull.

In 1997, China officially released its first national standard for sockets, with Bull Group as a key member of the standard-setting committee, participating in drafting and developing the entire standard. This involvement not only solidified Bull's position in the industry but also laid a strong foundation for its future development. All of this was possible thanks to Bull’s continuous investment in product research and innovation.

Amid the industry’s rapid rise, Bull successfully associated "electrical safety" with its brand, eventually making the brand synonymous with the category in consumers' minds. In the fiercely competitive industry, Bull achieved the leadership position.

Sales Channels: Building Sales Channels with a Fast-Moving Consumer Goods Mindset

The socket industry had a low entry barrier, attracting many companies and leading to intense competition. To gain market share, many companies resorted to price wars. However, Bull chose a different path. Due to its focus on product quality and R&D investment, Bull’s production costs were higher, which meant its product prices were 50%-60% higher than the market average. This pricing strategy initially made it difficult for Bull to achieve high sales, and the company even faced challenges paying for utilities.

At the time, the mainstream sales model was for brands to develop provincial or city-level distributors who relied on local wholesale markets to sell products to hardware stores and other terminal sales points, with distributors waiting for customers to come and buy. However, Ruan Liping noticed the difference in Coca-Cola’s distribution model, where distributors proactively delivered products to end customers, going door to door.

Inspired by Coca-Cola’s sales model, Ruan decided to change the traditional sales strategy and adopted a more proactive approach. He proposed the idea, "If Coca-Cola can sell like this, we can sell sockets in the same way," encouraging Bull’s distributors to step out and directly serve end customers. This strategy not only expanded the number and quality of retail outlets but also included performance assessments.

To further incentivize distributors, Bull increased rebate offers and set clear terms: a policy of exclusive sales, meaning distributors could only sell Bull’s products. If a distributor violated this rule and sold other brands, Bull would impose penalties based on the contract.

Through this proactive market expansion strategy and strict channel management, Bull established deep partnerships with more hardware stores. According to Bull’s official data, the company now has over 1.1 million offline sales points nationwide.

Through its innovative sales model, regularly scheduled deliveries, and distribution, Bull connected the numerous small hardware stores across China into a network, enabling real-time understanding of demand, pricing, and inventory, thus better adapting to market changes and improving after-sales services.

Hardware Store Signage: Low-Cost, High-Impact Advertising

The value of hardware stores was not only in their role as terminal sales points but also as an important platform for Bull's brand promotion.

In the early years, when Bull lacked funds to advertise on television or in newspapers, it discovered a low-cost advertising method: hardware stores themselves were the most precise advertising spreaders. Bull paid for the creation of signs for hardware store owners, with the only requirement being that they feature Bull’s logo and slogan. The store owners did not have to bear the cost of making the signs, making them more willing to accept this offer.

Bull’s advertisements began appearing on the signage of numerous small street-side stores. Given the large number of hardware stores in every street and alley, Bull’s brand quickly spread nationwide, and nearly every Chinese consumer became familiar with Bull—the leader of the socket industry.

Each hardware store only had one storefront sign, a scarce resource, which, once occupied by Bull, made it difficult for other brands to claim that prime advertising space. Compared to TV and newspaper ads, store signage had the added advantage of sustained exposure—only when the store closed would the sign be taken down.

This signage, coupled with Bull’s nationwide distribution network, contributed to over 80% of the company’s annual performance.

Category Expansion via an Established Dealer System

Sockets, as a branch of the civil electrical market, have relatively low added value. The civil electrical market as a whole is massive and includes numerous sub-segments. Apart from converters (sockets), it also covers wall switches, LED lighting, and other sectors. These sub-markets have different technical characteristics and market demands, forming a diverse landscape in the civil electrical market.

Given that civil electrical products are durable consumer goods with low unit prices and infrequent replacement cycles, Bull would struggle to maintain its position by focusing on a single product category. Therefore, Bull’s diversification was an inevitable trend.

Ruan Liping once stated: "We first draw a circle within our capability, and when we become the leader in that circle, we draw a bigger one. These circles are not drawn arbitrarily; they are based on our capabilities and strengths."

Leveraging its powerful distributor system, Bull successfully expanded its product line from sockets to other areas. In 2007, Bull officially entered the wall switch and socket market. In 2014, it expanded into the LED lighting sector. These decisions were benefitted by the booming Chinese real estate market. Between 2009 and 2017, the compound annual growth rate of the LED general lighting market reached an astounding 54.62%.

By 2020, Bull had integrated its wall switch socket, LED lighting, and smart home businesses—including smart bath fans, locks, drying machines, and curtain systems—into a smart electrical and lighting division. According to the 2023 financial report, this segment’s revenue reached 7.9 billion yuan, accounting for 50.43% of total revenue, breaking free from its dependence on sockets and achieving diversified development.

E-commerce Era: Responding to Channel Crisis

Many companies that achieved great success in offline channels were overtaken by competitors in the internet era, often because they didn’t keep up with the channel developments or failed to develop e-commerce channels, missing out on the benefits of the channel revolution.

How did Bull respond to the changes in channels in the e-commerce era? As early as 2015, Bull sharply captured the trend of changing consumer purchasing habits and quickly expanded into e-commerce channels. To ensure the coexistence of online and offline businesses, Bull implemented a moderately differentiated product strategy to avoid direct price conflicts across different channels, successfully building a more diverse and comprehensive sales channel network.

Thanks to consumer recognition of the Bull brand, even with the changes in purchasing methods, other socket brands still couldn’t shake Bull's market dominance on e-commerce platforms.

Brand Youthfulness Path for Legacy Manufacturers

Disruptions often don’t come from direct competitors but from changes in the era. When Bull was leading the socket industry, Xiaomi’s intervention brought significant market disruption, which made Bull realize that its position was not unshakeable.

Xiaomi adopted the "ecosystem chain" strategy, targeting younger users and emphasizing the development of e-commerce channels. Over the years, Xiaomi has achieved remarkable success in the IoT field. In 2015, Xiaomi launched a power strip with USB ports, positioning it as "the art piece among power strips," attempting to capture the traditional socket market with high cost-effectiveness and design.

With its large internet user base, Xiaomi’s power strip was quickly embraced by young consumers due to its compact design and three USB charging ports.

Bull's response was faster than expected—just three months later, Bull launched a similar power strip. With a strong reputation for quality and trendy design, Bull’s version also became very popular.

Power strips require high safety attributes, and compared to Xiaomi's focus on "artistry," users placed more trust in Bull’s built-in "safety," which helped Bull retain its dominance in its core business.

Ruan Liping publicly expressed gratitude to Xiaomi, acknowledging that Xiaomi helped Bull stay in tune with the internet trend and recognize user needs, preventing Bull from being left behind by the times.

Looking Ahead: Can the Charging Pile Business Secure Bull’s Future?

As a giant that rose during the traditional manufacturing era, Bull Group’s advantage in the socket field is undeniable. However, in the charging pile business, Bull does not have a significant edge.

First, Bull is an independent charging pile manufacturer, and its biggest competitors are the charging piles produced by automakers, which are often provided with the car. Bull's market is more focused on public charging piles or collaborations with automakers as solution providers.

Second, the traditional distributor channels primarily focused on hardware stores are not suitable for the charging pile business. Bull has already begun nationwide招商 efforts for its charging pile business.

According to Bull’s 2023 financial report, its charging pile business showed revenue growth, accounting for 2.42% of total revenue, and has huge potential for growth.

How will Bull achieve breakthroughs in this area? We will continue to follow and update this article.

A Simple Summary of Bull's Success

Opportunities of the Times

Early stage of China’s manufacturing industry.

Industrial cluster advantages in Cixi.

Development of China's real estate market.

Core Lessons from Its Business Model

Brand and product positioning—safety.

Establishment and innovation of distributor system—proactively reaching out.

Hardware store signage—locking scarce resources.

Bull is one of the typical examples of China’s manufacturing rise. By summarizing Bull’s growth, can you identify similar transformative business opportunities in your own country, leveraging the resources you have?